Increasing Condo/Strata Property Insurance

Increasing Condo/Strata Property Insurance

Increasing Condo/Strata Property Insurance

March 2020

While the Property and Casualty (P&C) insurance market is not something that normally attracts much media or public attention, recent developments affecting strata (the term in BC; basically “condominium” in most of the rest of Canada) corporations in British Columbia have reversed this.

Strata boards, particularly those in Metro Vancouver, have seen their insurance costs shoot through the roof in recent months, with reports of eye-watering premium increases of up to 750%, vastly increased deductibles and, inevitably, much higher monthly fees for unit owners. Some strata boards have reported that P&C coverage is simply unavailable to them.

Given that maintenance of P&C coverage by strata corporations is a fiduciary obligation, this situation is causing considerable, and understandable, distress.

So what is going on? Is this trend likely to spread across the country? Will it affect freehold owners? And how might builders and developers be impacted?

CHBA has an ongoing working relationship with the insurance industry, particularly around the issue of climate resilience. This article summarizes the Association’s understanding of the factors contributing to recent P&C trends in BC, and across Canada.

In a Nutshelll

- P&C premiums are rising nationally, and for all types of building, because insurers have seen their investment earnings and return on equity falling in recent years, as claim costs have mounted. Higher premiums are their only other source of revenue. Generally higher premiums will likely have some impact on all homeowners, regardless of where they live.

- In BC, homeowners are being particularly hard hit, due to updated risk modeling that indicates that catastrophic risks in many areas of the province (seismic, flood and wildfire related) are somewhat higher than previously calculated. This is being reflected in additional upwards premium adjustments.

- Specifically in relation to strata buildings in BC, recent claims experience, particularly related to water damage resulting from aging pipes and occupant behavior, is driving premiums even higher. Fewer P&C firms are writing coverage for these buildings, and many are limiting their total level of exposure, leading to a very hard market for strata P&C coverage with sharply higher premiums and deductibles. Older wood frame buildings, or those with any history of water damage claims, are likely to be hit the hardest, or simply find that insurance has become unavailable.

The More Detailed Story

As indicated, there are both general and specific reasons for the P&C insurance situation in BC.

In general, there are a number of trends in the P&C business that will impact property owners across the country through generally higher premiums.

- P&C insurers around the world have been growing premium volume simply by raising rates, in part to compensate for mounting liability and catastrophe losses as well as lower yields on fixed-income securities.

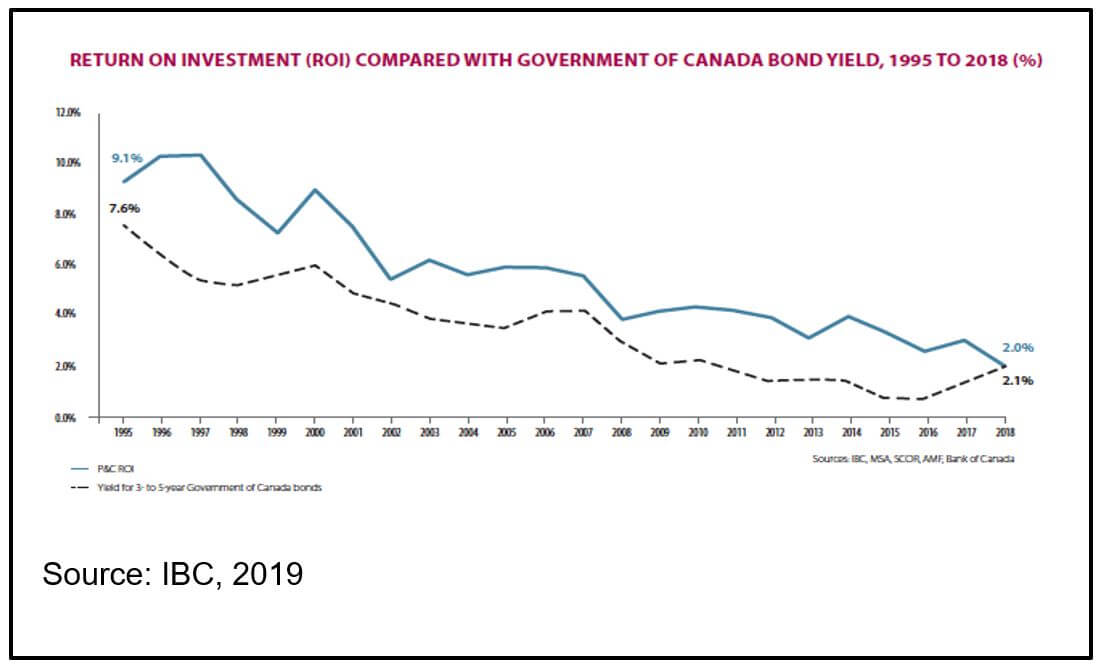

- Canadian P&C insurers have seen their return on equity (ROE) and return on investment (ROI) fall sharply in recent years, due to rising claims and lower interest earnings.

In relation to property losses as a share of total losses paid out, these have increased from about 25 percent to over 36 percent in the last decade.

As a result, general increases in P&C premiums have been occurring, and are expected to continue. Some reports pegged the average premium increase for 2019 at 8 percent. In summary, insurance costs have been trending upwards for everyone, and are expected to continue to do so.

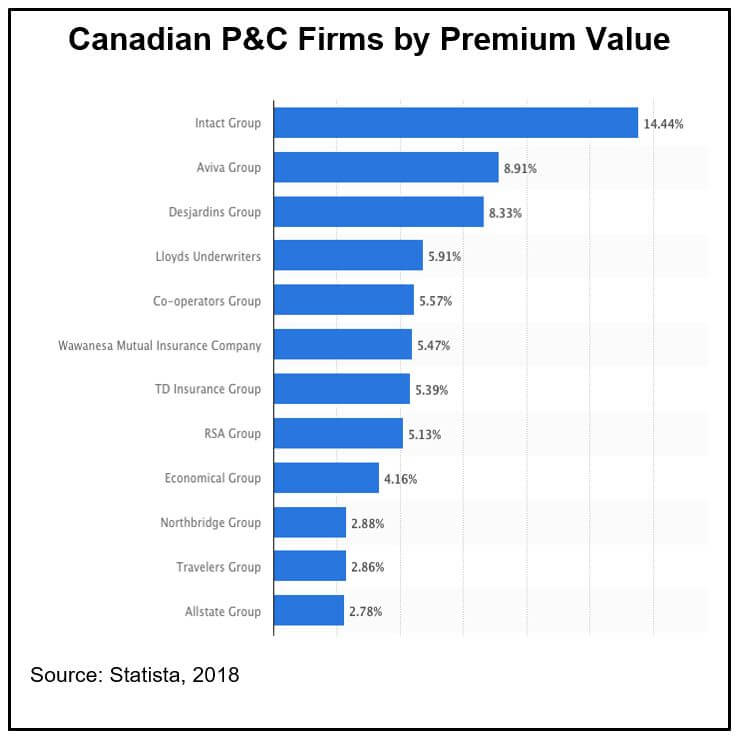

- Like the banking sector, the P&C industry in Canada is highly concentrated. While there are nearly 200 companies active across the country, the top five by premium value account for over 43 percent of all business. The top eight firms account for nearly two-thirds. If a large insurer moves to limit their exposure to a specific type of P&C risk or region, lack of capacity can ‘harden’ the market as has been the case in BC.

- The rising cost of catastrophic losses (flooding, fires and wind events), and the very high administrative costs associated with these events, has led the P&C industry to invest heavily in more technologically-advanced modeling and risk forecasting.

- As insurers gain better insight into their risk exposure, premiums are being adjusted accordingly. Their ability to write policies is also impacted by restrictions places on them by re-insurers that ‘buy on’ the underlying risks.

More specifically in relation to P&C coverage in the BC strata market, there are additional factors that add to the sharp hardening of the market and skyrocketing insurance costs:

- Water damage claims in BC stratas, particularly in older buildings that are of wood frame construction, have been increasing at a rapid rate. Flooding from a third or fourth floor unit due to a pipe break, or laundry overflow, can result in extremely high repair costs affecting many units on lower floors. If a strata has a history of water damage claims, or is of a type or age where such claims are more frequent, insurance costs and availability will be problematic. Not all strata buildings will fall into this risk category, but it may take some time for matters to sort themselves out.

- Given the corporate concentration in the P&C space, if a large company decides to limit its exposure to a specific risk category, like strata corporations, in a specific region like the lower BC mainland, the market can be significantly impacted. This appears to be happening. There is an apparent lack of capacity for underwriting in this area of the market.

- Catastrophic loss risks in BC have been rising, in part due to better risk modeling (in relation to flooding) and new knowledge about natural systems (seismic events) and this higher risk is now being reflected in premiums.

What Might this Mean for Developers and Builders?

P&C insurance is a critical part of Canada’s housing finance system. Insurance underpins the mortgage market, and provides financial security to homeowners. It is essential.

CHBA has been actively working with insurers and other experts to assess the risks associated with a changing climate and more frequent extreme weather events. In the coming years, we expect that this work will provide builders and developers with better design and decision-making tools to construct more resilient building that are less susceptible to natural disasters, and so more insurable at a lower cost to buyers.

The current hard market for P&C coverage among strata corporations in BC reflects a ‘perfect storm’ of factors, some of which are national in scope, others of which are quite specific to the region and these buildings. Developers and builders planning a strata development are encouraged to discuss insurability with their brokers, as there may be minor adjustments which would reduce P&C coverage costs for eventual strata owners and provide a compelling market advantage.